Customer Lifecycle Management

The leading provider to independent financial advisors in the U.S. implemented Intelligent Automation and achieved cost savings of $1M+, while enabling growth for financial advisors.

This paper is written for organizations that have already come to understand the benefits of perpetual KYC (pKYC) programs but need more insight on how IA is the true means to success.

Gain keen insights on how Intelligent Automation can help you tackle a more robust sanctions compliance program and follow KYC best practices while potentially reducing costs.

Customer Lifecycle Management is overloaded with unstructured documents

Financial institutions invest in digital experience for many reasons, but none is more important than attracting and retaining satisfied customers. However, while many of them have digitized customer-facing interfaces, the most time-consuming and error-prone work – extracting and matching data from documents and updating systems of records — is still done manually, degrading customers’ experiences, slowing account opening and generating quality and compliance errors in back-office operations.

Manual operations are at the core of CLM inefficiency

Manual operations constitute 50–75% of all work in Customer Lifecycle Management, and their inefficiencies lead to poor customer experience and, as a result, customer churn:

- On average, an extra 7–15 days are added to onboarding time per corporate customer, and 1–3 days per retail customer, due to manual work

- 40% of corporate customers report dissatisfaction with their bank’s customer service

- Annually, 15% of retail customers quit their bank and move to a competitor

The cost of getting it wrong is higher than ever, especially when new fintech players offer simpler access to banking services, without the complexity and manual work of traditional financial services providers.

Source: BSG.Com

The negative effects of over-relying on manual work are not limited to customer churn and subsequent missed revenue. It also leads to growing operational costs: Mid-size banks spend as much as $50M annually on CLM, while the cost for large banks can easily exceed $500M.

Intelligent Automation streamlines CLM operations

More banking operations leaders are turning to Intelligent Automation to improve operations with documents and systems of records across the customer lifecycle.

Applying an Intelligent Automation layer across CLM operations allows financial institutions to rapidly speed up manual operations such as customer documents processing, avoid backlogs and provide superior customer service, creating a faster and more customer-driven operational model.

WorkFusion’s platform can solve key sticking points across the customer lifecycle:

- automatically processing, categorizing, and routing customer communications to manage the outreach process;

- intercepting data and documents, extracting key information from documents of various templates and feeding the BPM and document repository layers;

- routing client information to screening engines and risk-rating systems, etc., all in near-real time.

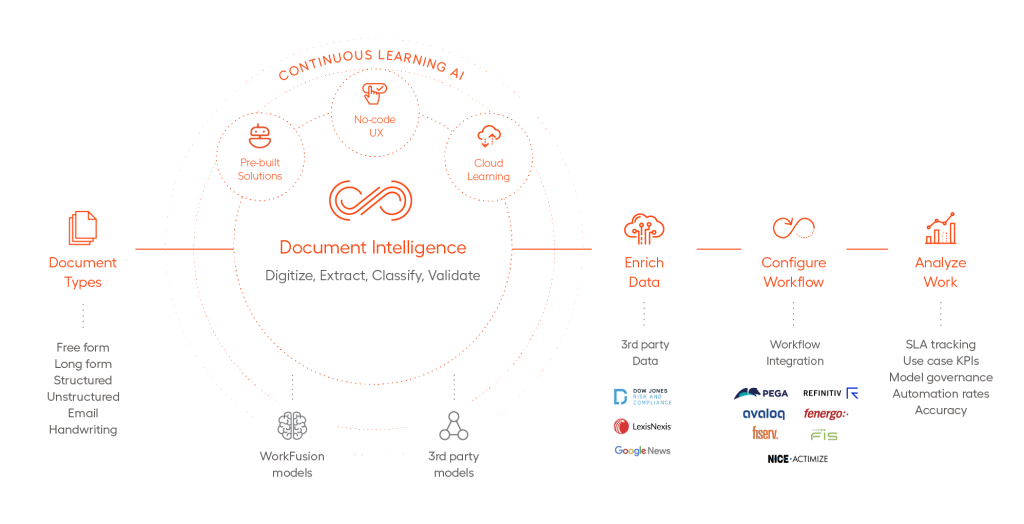

The Continuous Learning Framework ensures non-stop development of the bots and improvement of their automation rates and accuracy.

End-to-end process automation is made possible with the combination of our Intelligent Automation capabilities:

Want to learn more?

Read about WorkFusion’s Account Opening and KYC automation solutions and critical capabilities of Intelligent Automation, find more success stories, white papers and analyst reports on our website.

They will help you select the best use case for your business and demonstrate how to scale the automation further with Intelligent Automation Cloud.