Foreign Account Tax Compliance Act (FATCA) Screening

Ensure compliance with the Internal Revenue Service’s FATCA regulation by automating the manual and error-prone process of screening accounts to check clients’ tax-obligation links to the U.S. with WorkFusion® Intelligent Automation.

Why it is important

The Foreign Account Tax Compliance Act (FATCA) was introduced to prevent offshore tax evasion by U.S. citizens. As a result, non-U.S. banks must screen for and report U.S.-linked accounts or be subject to 30% withholding from U.S.-linked proceeds for non-compliant account holders. For each U.S. account, banks are required to report the account details, holder details, balance and movements on an annual basis.

What needs to be improved

The existing FATCA screening process has a number of challenges:

-

Complying with FATCA is a time-consuming manual task for non-U.S. banks.

It adds to the multiple processes already required during onboarding and increases customer due diligence efforts.

-

Failure to comply can lead to penalties.

They can include a 30% tax on all transactions with U.S. banks, and other sanctions, such as being banned from the SWIFT foreign banking exchange system.

-

Risk of losing U.S. customers.

Some banks have to choose between being FATCA-compliant or rejecting U.S. customers.

-

Information often arrives in unstructured emails or faxes.

This information must be understood and then associated with the right customer and case for further actions.

How WorkFusion can help

WorkFusion helps you manage the challenges of this additional regulatory requirement by bringing automation to the FATCA-screening process.

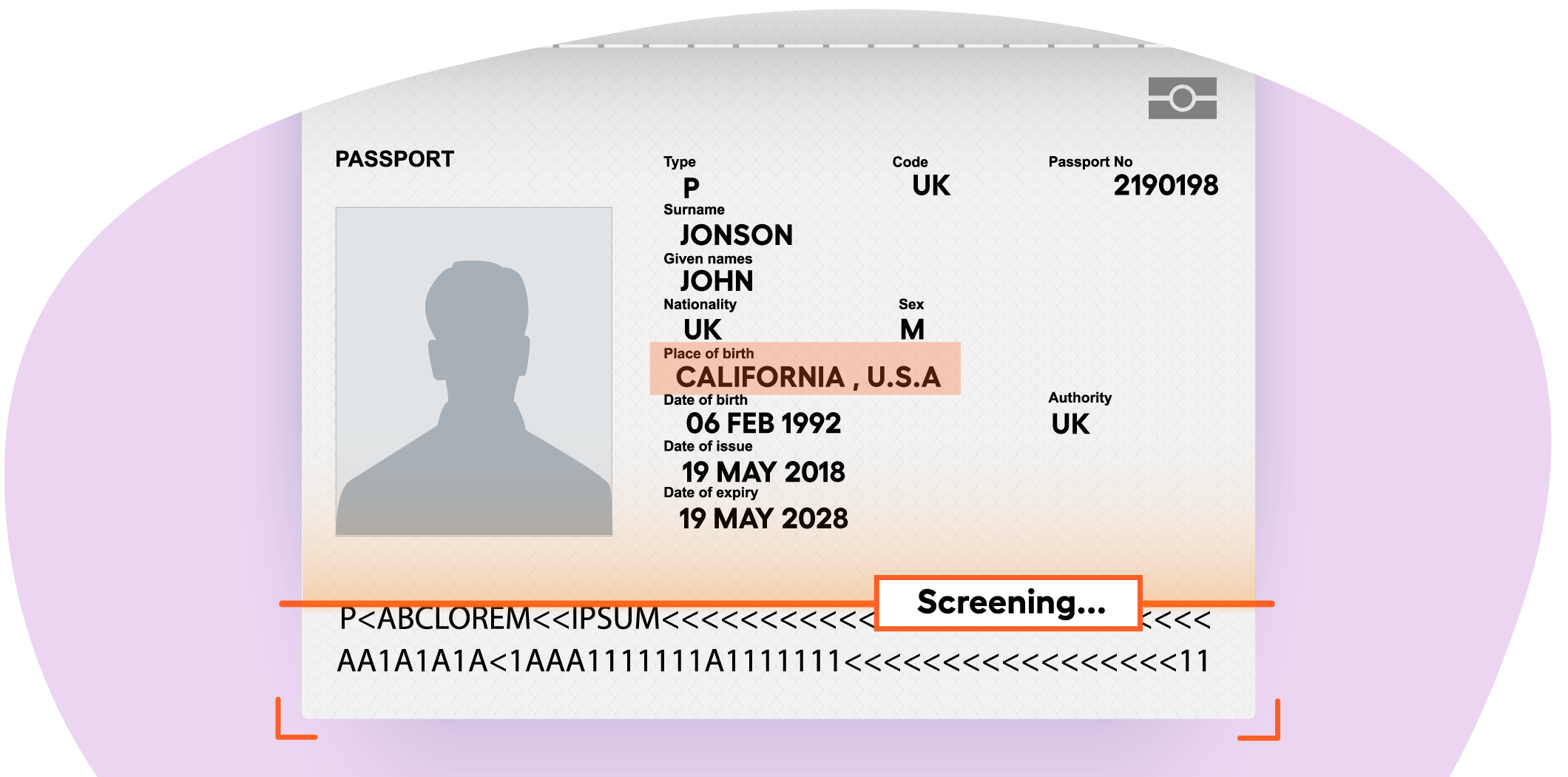

Pre-trained bots digitize and review documents presented by customers to verify a connection to the U.S. WorkFusion’s AI-native capabilities allow you to handle a variety of document types and formats, including multiple forms of identification, employment letters, U.S. tax forms and more. If a link to the U.S. is established, the account is flagged for reporting to the IRS.

Document types

- W-8 forms

- W-9 forms

- Employment verification letters

- Identity documents