Name Screening Alert Review for Sanctions and Politically Exposed Persons

Streamline the process of name screening alert review with WorkFusion® Intelligent Automation and reduce cost and manual efforts involved in determining whether a customer is a politically exposed person (PEP) or on a sanctions list.

Why it is important

A critical component of KYC controls is name screening. This determines whether a customer is a politically exposed person (PEP) or on a sanctions list. Bank employees get thousands of alerts every day from their name-screening software, list providers, and databases – with the majority of them being false positives – and spend a substantial amount of manual effort to review and resolve them.

Banks use databases and screening software to identify politically exposed and sanctioned individuals during the onboarding and periodic-refresh process. This can result in thousands of daily alerts that must be manually resolved by bank employees to determine a customer’s risk profile. Mistakes and failure to comply can lead to heavy penalties and allow bad actors to misuse a bank’s services.

In case of a true PEP alert, the person’s risk rating must be increased or escalate for review. In case of a true match for a sanctions alert, the person’s account must be blocked.

What needs to be improved

Currently, banks face several challenges that prevent them from conducting efficient enhanced due diligence checks:

- Majority of alerts are false positives and must be resolved manually by bank employees

- Manual effort causes delays and mistakes in KYC completion

- Disposition of alerts requires gathering information from multiple internal and external sources

How WorkFusion can help

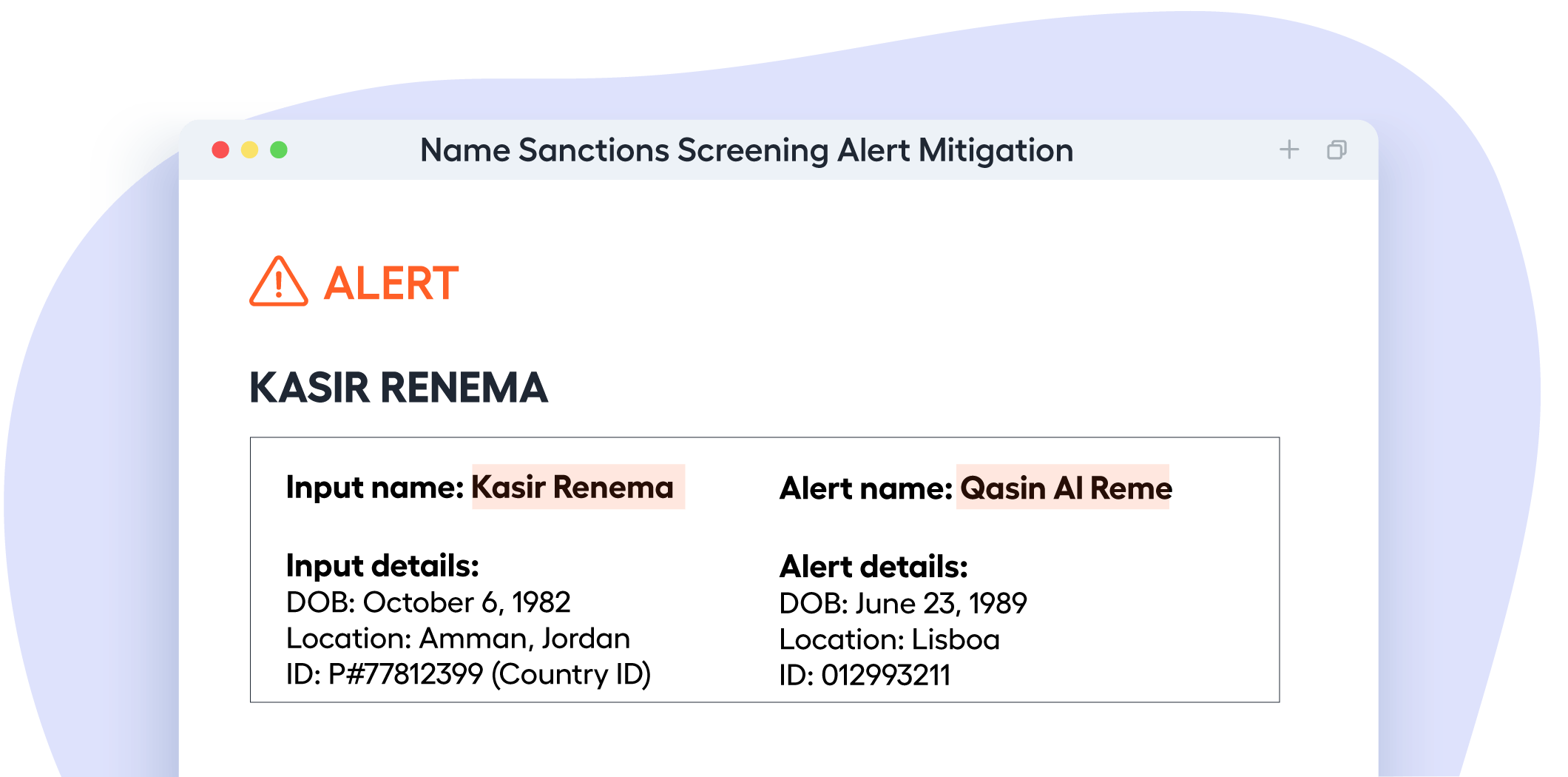

WorkFusion’s pre-trained ML bots determine if an alert on a customer’s name is a true match or a false positive. The bot makes this judgment using a bank’s internal KYC data, including age, gender, and location, as well as external data sources for confirmations, such as connecting to government information portals.

Automating the PEP and sanctions alert reviews helps drastically lower the number of false positives a person must review manually, thus reducing time and manual effort required while increasing accuracy and auditability.

See how it works

Document types

- Alerts generated by screening software and databases

Supported integrations

- Accuity (RELX Group)

- WorldCompliance (LexisNexis)

- Lexis Diligence (LexisNexis)

- World-Check (Refinitiv)