Source of Wealth

Automate checking the source of wealth for customers to identify unusual or unexplained funds flows with WorkFusion® Intelligent Automation.

45%

reduction of manual work

2x

data corroboration

Transparency

with a single audit trail

Why it is important

Because of tight regulations, banks need to check the sources of wealth for new and existing customers to ensure it’s not from criminal sources. This review is critical for higher-risk customers and during enhanced due diligence.

What needs to be improved

The existing process is challenging, involving:

- Complex sources and interconnections, including companies, inheritance, gifts, etc.

- Complicating factors, such as PEPs, sanctions, shell companies

- Uncertainty and opaque information that necessitates reliable corroboration and documented justification

- Large volume and tailored analysis (one template does not fit all)

How WorkFusion can help

WorkFusion’s pre-trained bots automate the most time-consuming parts of Source of Wealth analysis and orchestrate the remaining human analysis to improve consistency and quality.

Enhancing research and analysis of sources of wealth for new and existing customers includes:

- sourcing data from internal and external systems

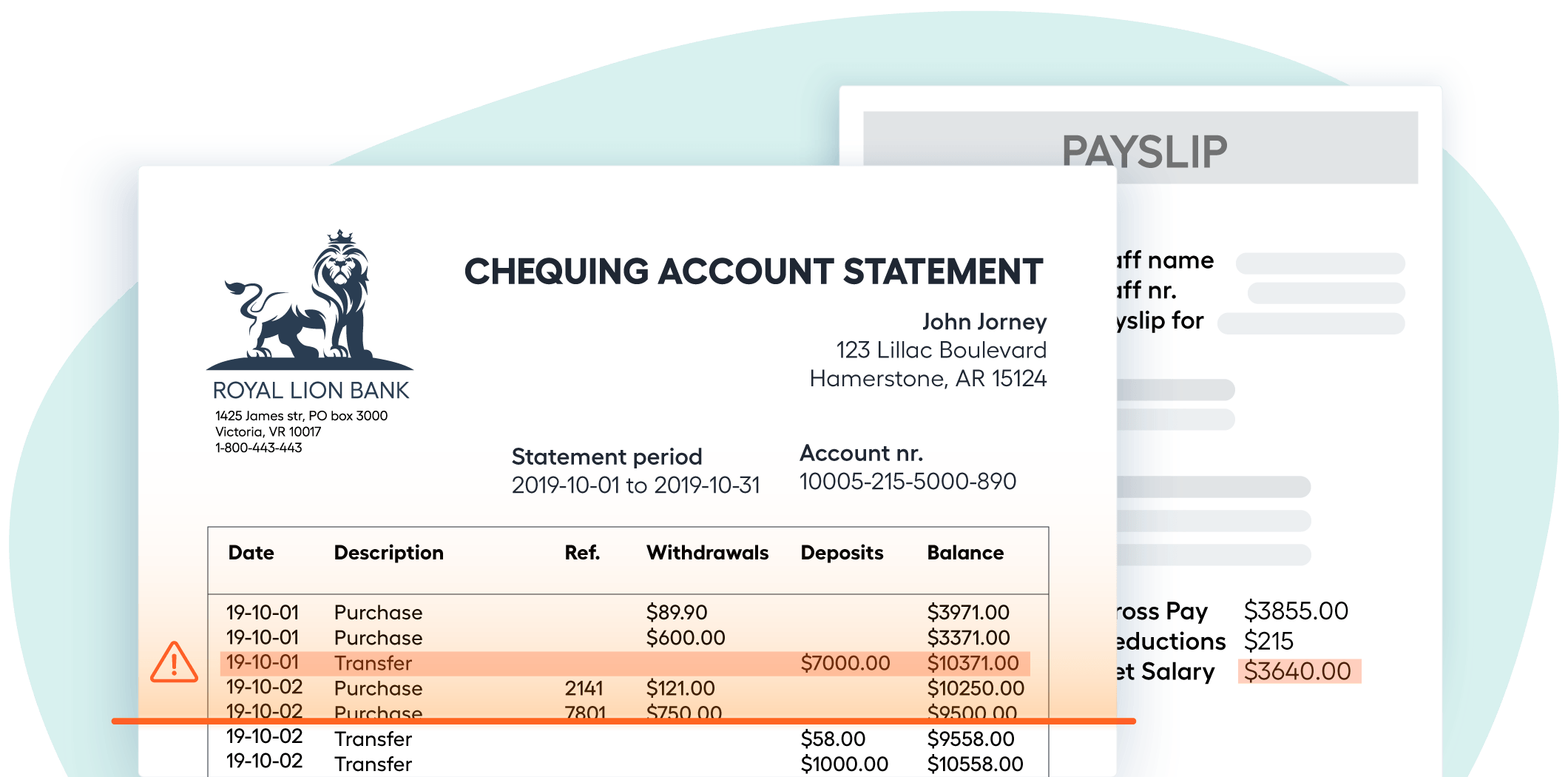

- extracting, analyzing, and corroborating the key data points across documents and data sources

Document types

- Employment records

- Tax returns

- Share certificates

- Pay slips

- Verifications from internal bank systems

Supported integrations

- Google News

- LexisNexis

- Factiva

- Dun & Bradstreet

- Internal CRM applications

Delivering the Future of AML

Read about common AML issues and get practical advice on how to design your own automation approach to these issues.

Customers who viewed this use case also viewed

Adverse Media Monitoring (Negative News)

Streamline investigation of negative news and reduce the risk of regulatory penalties with WorkFusio...

Payment Screening Alert Disposition

Streamline the manual review of alerts generated by your payment sanctions screening system with Wor...

Ultimate Beneficial Owner

Determine and assess the ownership and control structure of your client businesses faster and more a...

Name Screening Alert Review for Sanctions and Politically Exposed Persons

Streamline the process of name screening alert review with WorkFusion® Intelligent Automation and re...

AML and OFAC Risk Assessment

Financial institutions need to compare their AML/OFAC inherent risks with their control environment ...