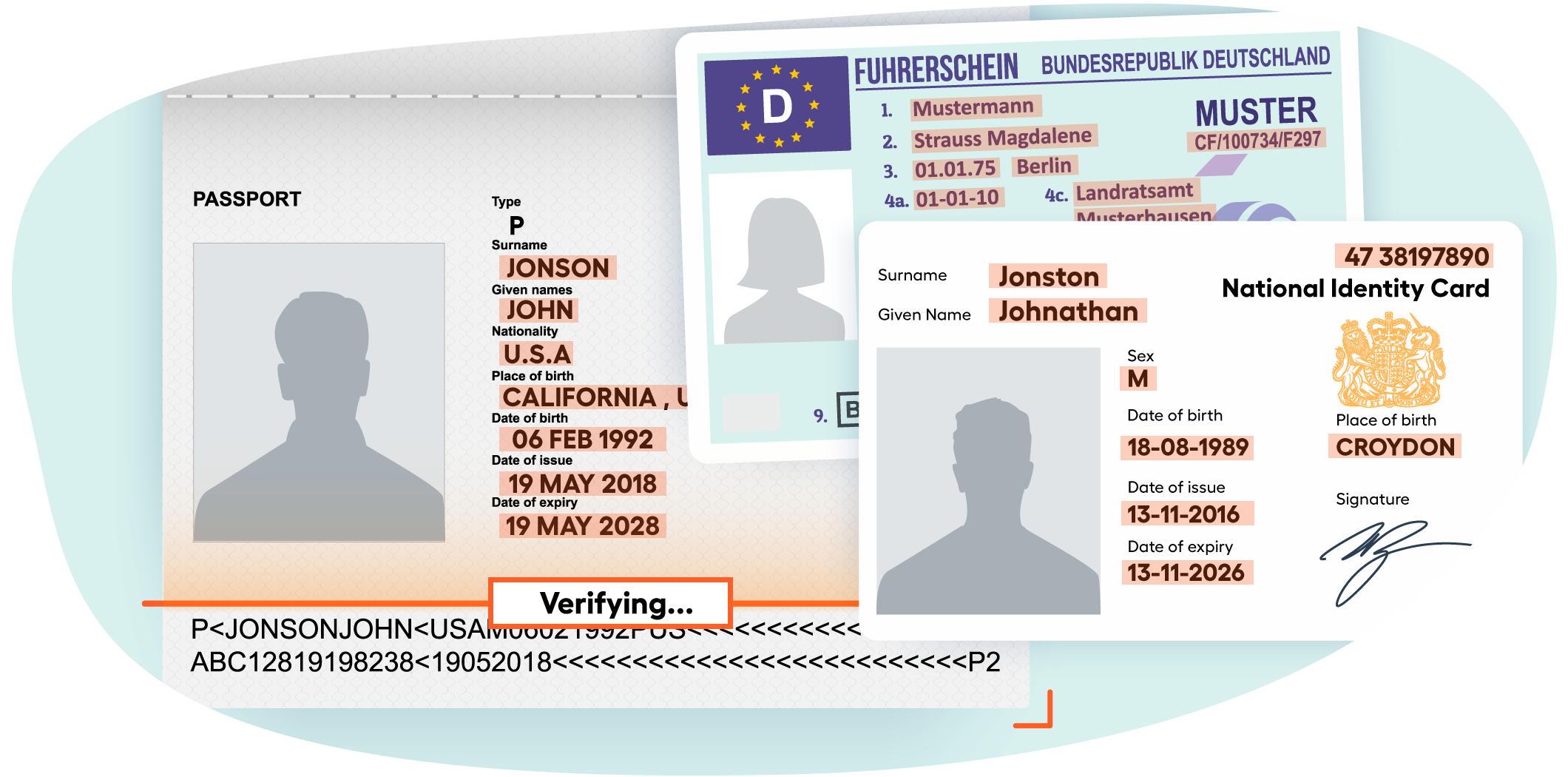

Identity Verification

Verify an account applicant’s identity through submitted documentation and data faster with WorkFusion® Intelligent Automation. Streamline Customer Identification Program (CIP) requirements for faster customer on-boarding.

How this solution works

Why it is important

Offering a superior customer experience is a major priority for any company, and the process of opening a new account is an excellent opportunity to make a positive first impression on potential customers. Identity verification is a critical part of customer due diligence and involves multiple steps that are data-intensive and heavily regulated.

This is why forward-looking companies rely on WorkFusion to ensure that account opening is a quick and seamless experience for their customers.

What needs to be improved

Traditionally, verifying a customer’s identity during the account opening process is highly manual, error-prone, and time-consuming. This can lead to subpar customer experiences, delayed responses, and increased labor costs as errors must be corrected.

Banks also must navigate:

- Unstructured and varied document types ranging from passports to utility bills

- High volume as verification is required for all customers, with 1000s of transactions daily

- Fraud and KYC risk from fake documentation and malicious actors

- Time sensitivity needed to deliver a smooth customer experience and maintain compliance

How WorkFusion can help

WorkFusion accelerates the process of document verification by extracting pertinent data from various documents such as passports and driver’s licenses, retrieving data from internal and external systems, and reconciling these all to uncover any discrepancies. The solution supports a wide range of international document types.

After automation, teams assess any mismatches—a more valuable use of their time than the mundane tasks of data extraction and matching.

With WorkFusion, an automated identity verification process can offer a superior customer experience, higher accuracy, and lower total costs.

Currently, this use case is successfully implemented in banks in the USA, India, Europe and Africa.

Document types

- Passports

- Driver’s licenses

- National ID cards

- Birth certificates

- Social Security cards

- Green cards

- Travel documents

- Utility documents

- Tax and medical bills

- Bank statements

- Legal letters

- Rental agreements

- Voter registrations

Supported integrations

- Core banking applications, such as Jack Henry

- Banking account opening tools, such as Fenergo

- Shadow IT point solutions, such as Excel macros