Adverse Media Monitoring (Negative News)

Streamline investigation of negative news and reduce the risk of regulatory penalties with WorkFusion® Intelligent Automation solutions.

How this solution works

Why it is important

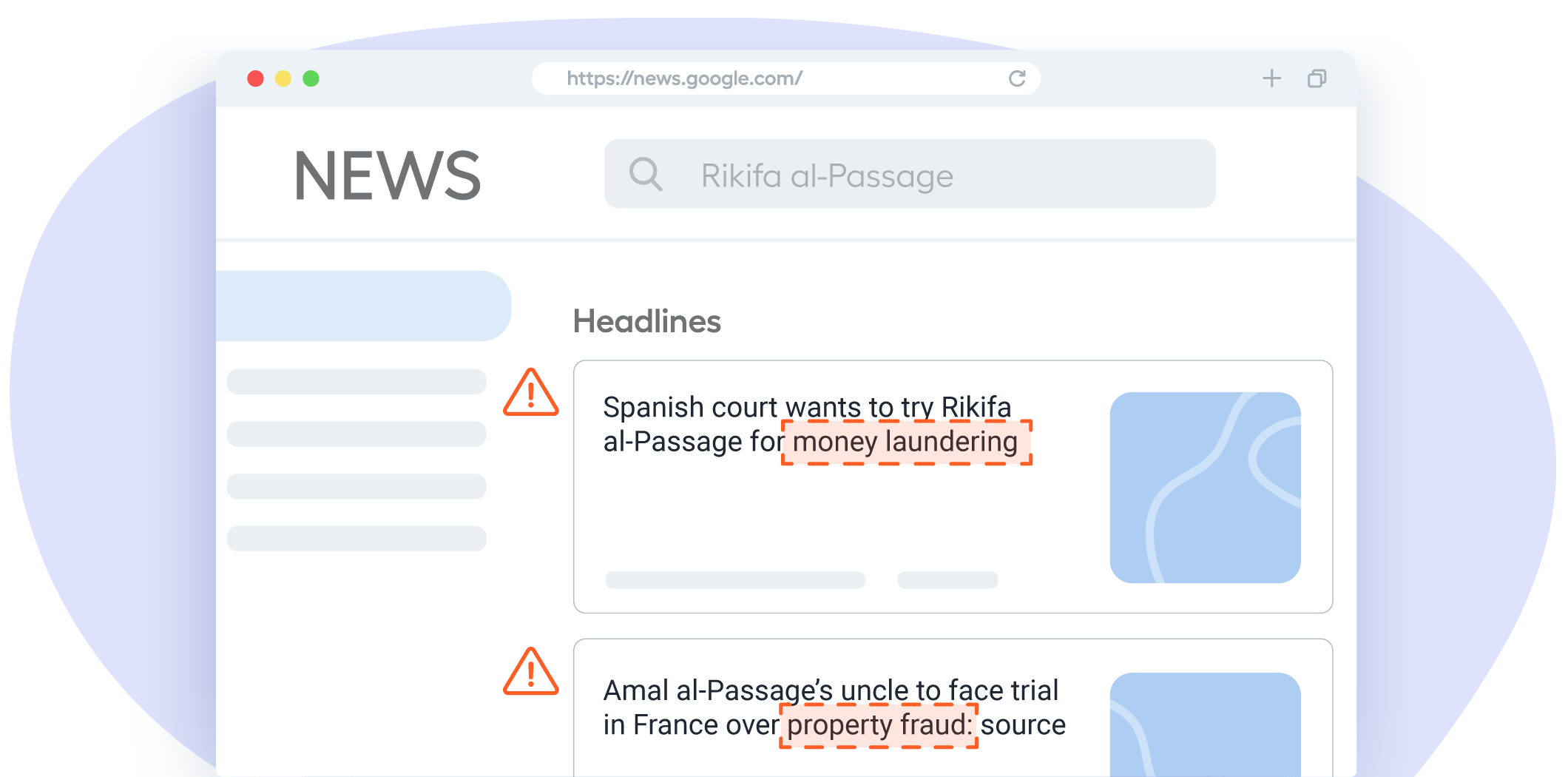

Negative news can indicate a potential risk of financial crimes. As regulations become tighter and banks are under scrutiny for AML compliance, negative news search has become one of the key functions required by regulators.

Banks allocate a big portion of employee time to this task. Analysts must review entities during the customer onboarding process and continually on a periodic basis. To do so, they search for news sources and interpret hundreds of results. The goal is to find any negative reports that suggest the customer or client is a risk — if necessary, triggering further investigation.

What needs to be improved

Analysts face several key challenges:

- Unstructured data requiring judgment and effort toward quality control to validate decisions

- High risk due to the “needle in a haystack” nature of this process and a low tolerance for error

- A fragmented process with tens to hundreds of analysts combing through mountains of news articles

How WorkFusion can help

WorkFusion Intelligent Automation streamlines the negative news search process and saves analysts’ time by:

- analyzing risk content, sentiment, relevant keywords, and compiling a list of flagged articles that need analyst attention and judgment

- explaining the risks described in news articles, helping analysts to make a decision 10x faster

- updating the data in core applications.

This solution helps to reduce manual work by 70% and enables the team to process larger volumes with higher accuracy.

Document types

- Online news articles

- Negative news alerts

Supported integrations

- Google News

- LexisNexis

- Factiva

- InfoNgen

- CLEAR

- Accuity (RELX Group)

- World-Check (Refinitiv)