Ultimate Beneficial Owner

Determine and assess the ownership and control structure of your client businesses faster and more accurately with WorkFusion® Intelligent Automation.

Why it is important

In the face of terror attacks, drug trafficking, and other nefarious activities, money laundering is a growing concern that cuts across borders and societies. This leads to the importance of banks and financial institutions taking their UBO (Ultimate Beneficial Ownership) compliance with utmost seriousness. Banks need to determine and assess the ownership structure of their client businesses consisting of all corporate relationships and people associated with the ownership of the business.

Financial institutions must perform enhanced due diligence to identify and verify who their customers are and where their funding originates, with the goal of preventing money laundering or terrorist financing.

What needs to be improved

Challenges include:

- Fragmented and inconsistent data in registers around the globe

- A large number of entities to be verified, increased by legal corporate structures with multiple layers of ownership

- A lack of standardized documentation across various countries

However, compliance with this regulatory requirement is labor- and time-intensive. Automation lifts this burden.

How WorkFusion can help

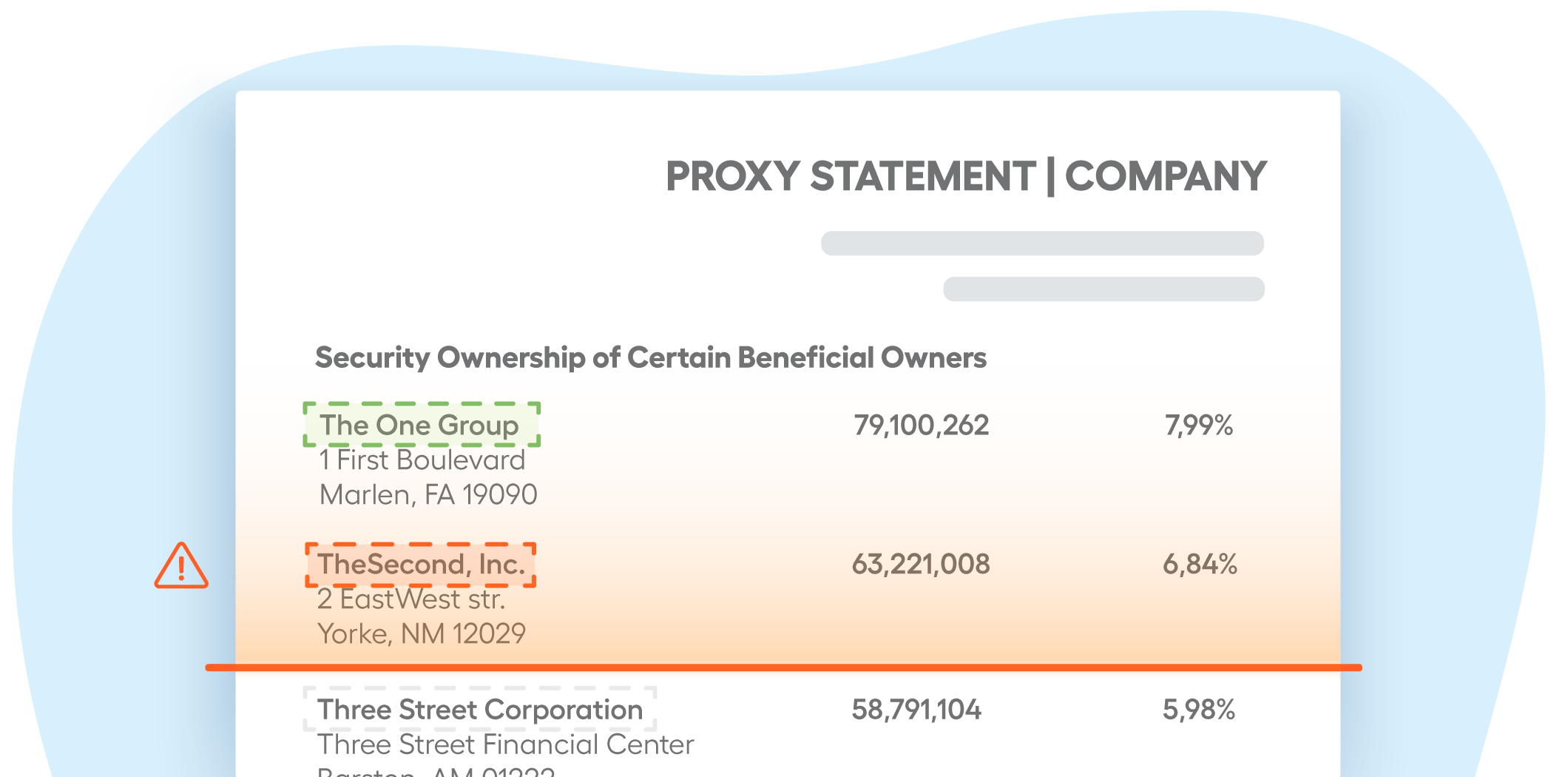

WorkFusion simplifies the identification and validation of a legal entity’s beneficiary ownership by:

- ingesting, digitizing and extracting key data from forms

- automating research of external sources such as Dun & Bradstreet, corporate registries, LexisNexis and others

- compiling a list of flagged articles that need analyst attention and judgement

It enables analysts to determine and assess the ownership and control structure of the bank’s clients at greater speed and efficiency, and ultimately to process larger amounts of deals.

Document types

- Proxy statements

- Corporate registrations

- Tax documents

- Shareholder agreements

- Certificates of incorporation

- Certificate of formation

- Memorandums and articles of association

- Shareholders registers

- Fund prospectus

- Articles for a foundation

- Form 5500

- Trust agreements

- Executed fund prospectus

Supported integrations

- Dun & Bradstreet

- LexisNexis

- Orbis

- Accuity (RELX Group)

- BVD