Payment Screening Alert Disposition

Streamline the manual review of alerts generated by your payment sanctions screening system with WorkFusion’s packaged automation solution.

Why it is important

Global banks process millions of payments per year. Rules-based sanctions screening software generates a significant number of alerts but, typically, 98% of these are false positives. These alerts must be reviewed, which includes identifying people, corporations, locations, and vessels from payment messages and comparing them against such alerts and external sources to recommend whether the issue can be resolved or escalated.

Banks have built large teams of people to manage the manual resolution of such alerts. These employees need to log in to payment sanction screening software, pick up the alerts, clear false positives and provide explanations.

What needs to be improved

The existing manual process poses these challenges:

- Variable text information requires judgment

- No errors can be tolerated due to the risk of fines, so each transaction must be reviewed by at least 2 people

- Any decision must be auditable and justified for regulators

- Repetitive tedious work might lead to errors

How WorkFusion can help

WorkFusion’s pre-trained ML bots review any payment messages for several common false-positive scenarios and conduct research to justify their decision-making, validating the scenario. The rationale is written in natural language to provide an audit trail and justify the decision. A person can then review the bot’s work and all the evidence in a single screen, making the final decision.

This moves the business from a four-eye maker-checker model to one where the bots are the makers, and experts are checkers who focus on new insights and quality control.

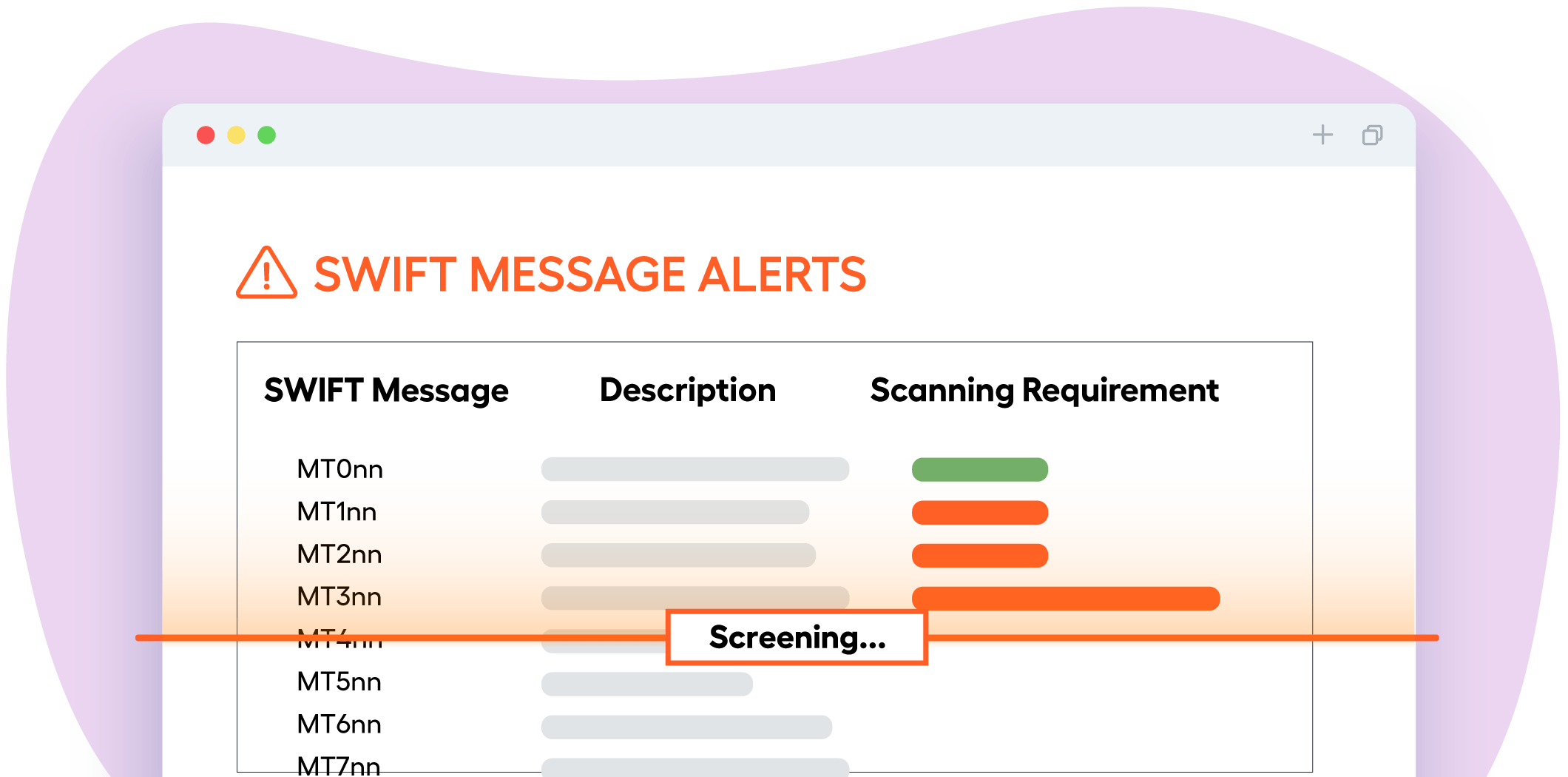

Document types

- SWIFT messages

- ACH

- IAT

- FedWire

- CHIPS

- CHAPS

- SEPA

- Other message types

Supported integrations

- Fircosoft

- SafeWatch

- Prime

- Egifts

- Actimize

- HotScan

- Sydel

- FiServ

- Verafin