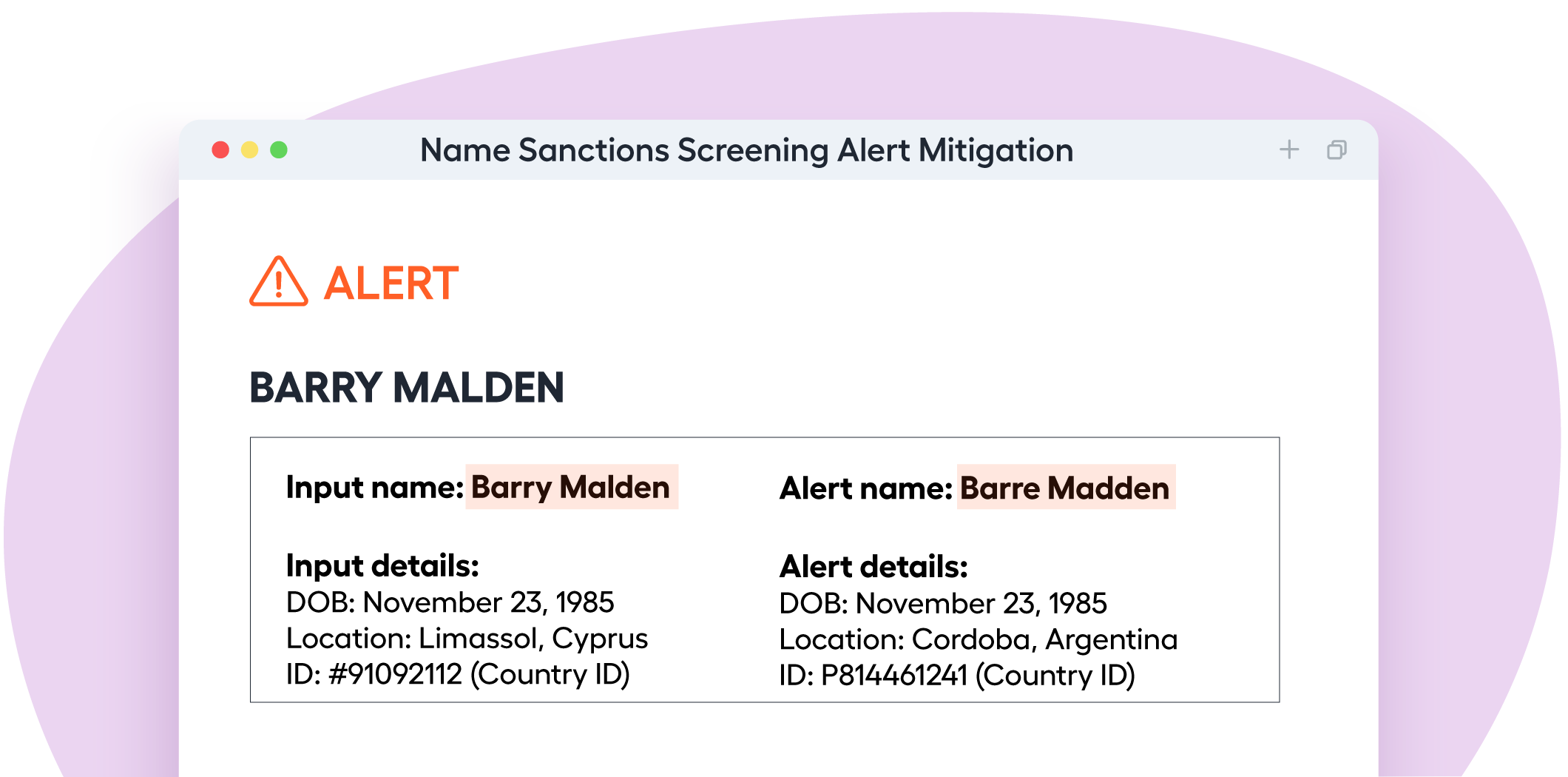

Insurance companies must handle thousands of alerts every day from their name-screening software, list providers, and databases – with the majority of them being false positives – and spend a substantial amount of manual effort to review and resolve them.

Thousands of daily alerts that must be manually resolved by analysts inside to determine an individual’s risk profile. Mistakes and failure to comply can lead to heavy penalties and allow bad actors to access policies and products that are inappropriate or put more risk on the insurer.

In case of a true PEP alert, the person’s risk rating must be increased or escalated for review and the customer’s account may need to be blocked.