Mortgage Document Verification

Streamline verification of mortgage documents and shorten processing times, enforce standardization and compliance, and improve productivity and customer satisfaction.

Why it is important

Home lending advisors spend considerable time verifying and validating the documents required for mortgage loan applications. Incorrect data can slow the underwriting process and create unnecessary questions between the bank and the applicant. Streamlining these manual tasks can shorten processing times and enforce standardization and compliance, which improves margins, productivity and customer satisfaction.

What needs to be improved

Both the mortgage application process and refinancing process require lengthy and complex document collection, which creates stress and confusion for customers and heavy workloads for home lending advisors. Submitted documents are unique per customer, yet perfectly suited for automation with machine learning — which can reliably collect and validate data related to customer income, applications, and external supplements.

Intelligent Automation is a critical tool for improving margins by ensuring a faster compilation of data required for decisions. It’s also the best solution for equipping teams to handle inevitable variations in application volume.

How WorkFusion can help

Customers dramatically reduce underwriting timelines with WorkFusion® Intelligent Automation.

-

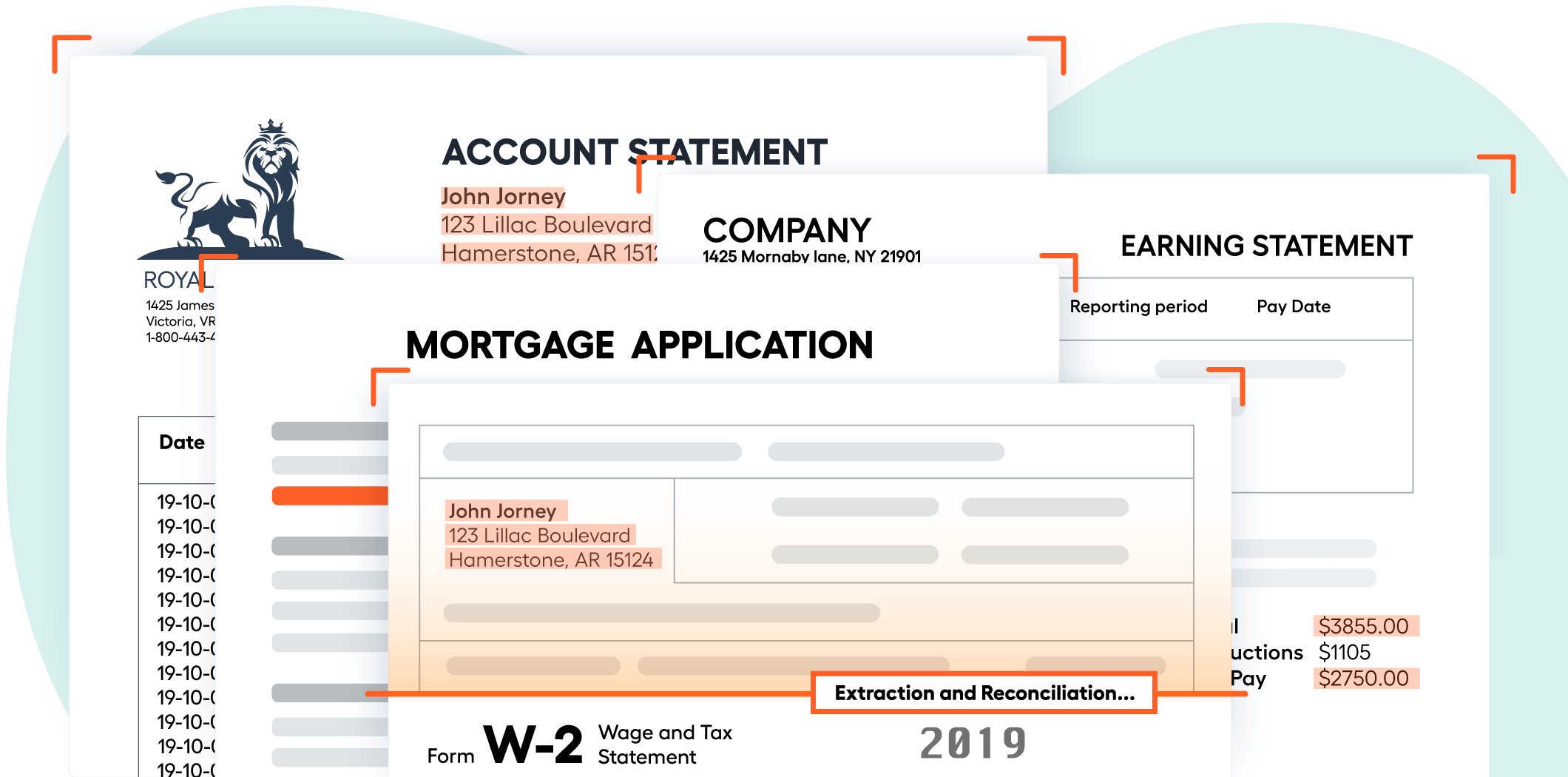

Classification

Pre-trained ML bots automatically classify and digitize incoming documents

-

Extraction

Important information is extracted from each document (e.g., name, employer name, pay), which can be easily referenced by agents interested in finding or validating data.

-

Reconciliation

Information is reconciled across documents to ensure consistency and flag anything that does not match.

-

Exceptions

Advisors are alerted to any exceptions or missing information.

-

Final alert

The advisor is informed when an application is complete and ready to move to underwriting.

Document types

- Pay stubs

- Bank statements

- W–2 forms

- Employment verification letters

- Appraisals

- Property tax documents

- Homeowners insurance

- MLS data

Supported integrations

- Encompass by Ellie Mae

- NCino

- Custom backend applications

- Origination systems

- Customer information systems