Medical Benefit Plan Entry & Processing

Onboard or renew medical benefit plans by automating benefit detail processing with WorkFusion’s Intelligent Automation solution.

Why it is important

Insurers are under pressure to meet increasing consumer expectations — especially when it comes to onboarding customers and approving benefits. Speed and accuracy are paramount to an ideal insurance customer experience. And of course, it’s best to capture key data as it arrives, without having to ask members for resubmissions.

Insurers also must compete on cost efficiency and optimize for their combined ratio. So it’s smart to take every opportunity to cut manual work from their underwriting operations.

What needs to be improved

Performing Medical Benefit Plan Entry & Processing manually is subject to several critical challenges:

- Intense effort: Average handling time for each case is 79 minutes!

- Errors: A typical inaccuracy rate is around 8%.

- Slow turnarounds: Fixing errors extends an already time-consuming process.

- High costs: Reserving dozens of FTEs for these tasks creates expense and contributes to a combined ratio degradation.

- Employee turnover: A large amount of training for new hires.

How WorkFusion can help

From Day 1, WorkFusion’s pre-built Intelligent Automation solution for Medical Benefits Plan Entry & Processing reduces manual effort by 80%+.

WorkFusion achieves this impact by:

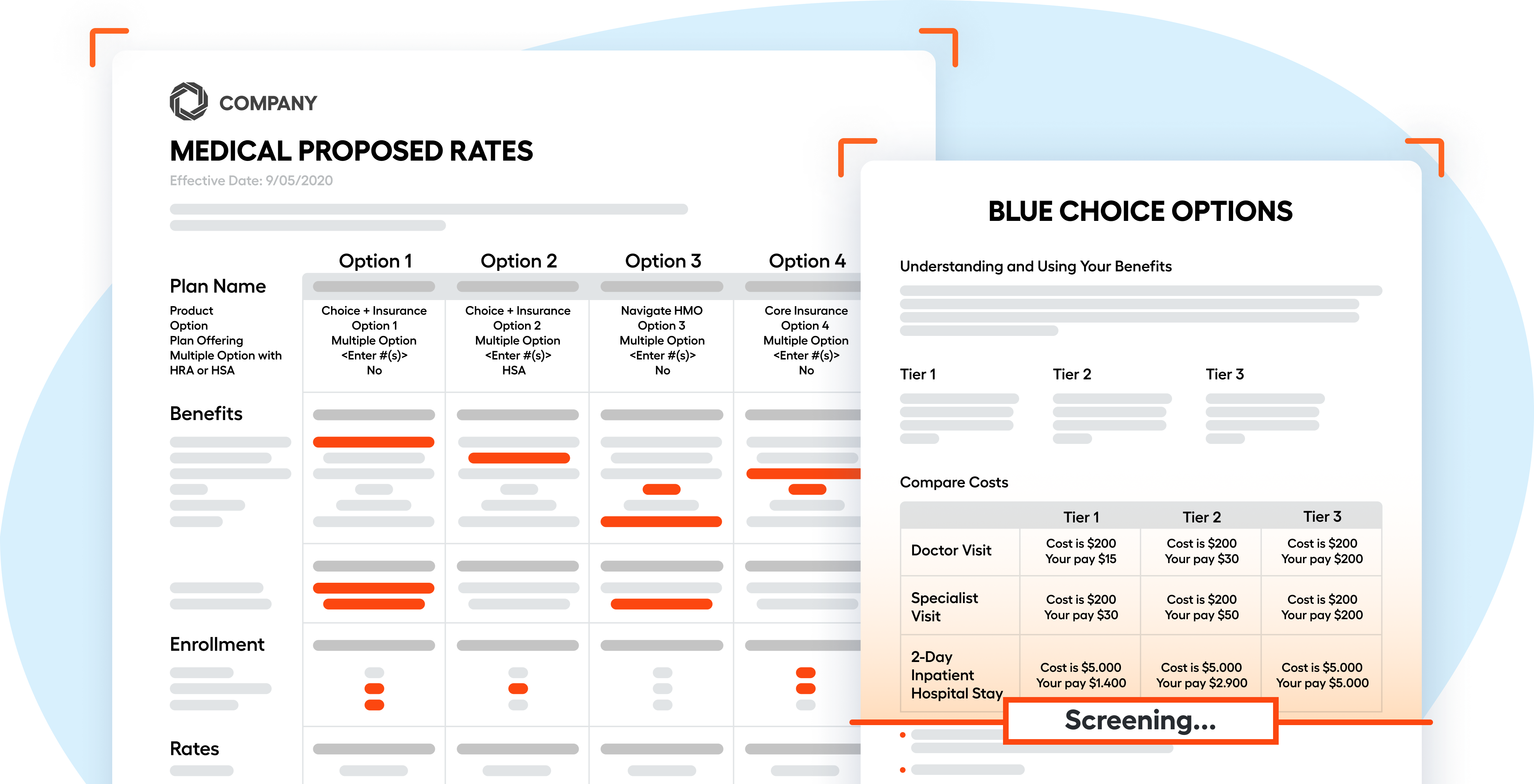

- automatically lifting medical plan documents

- classifying documents into types

- extracting key data points from documents across dozens of fields

- packaging structured data

- pushing structured data into the core underwriting system

Document types

- SBC

- SPD

- Benefit Summary

- Certificates

- Renewal/Welcome letter

- Proposal Revised

- Sold proposals

- Signed renewal

- Enrollment summary

- Sold renewal

- and more!

Supported integrations

- Email inboxes

- Excel

- Core underwriting system